Form 24Q is a comprehensive document for taxpayers to declare their TDS returns in detail. It comprises of two Annextures - Annexure 1 and Annexure 2. While Annexure 1 contains details of the deductor, challans, and deductee, it does not include salary details. This annexure needs to be submitted for all four quarters of the financial year. On the other hand, Annexure 2 must be submitted during the first three quarters of the financial year and includes detailed information about the salary, along with all deductions that the employee needs to claim.

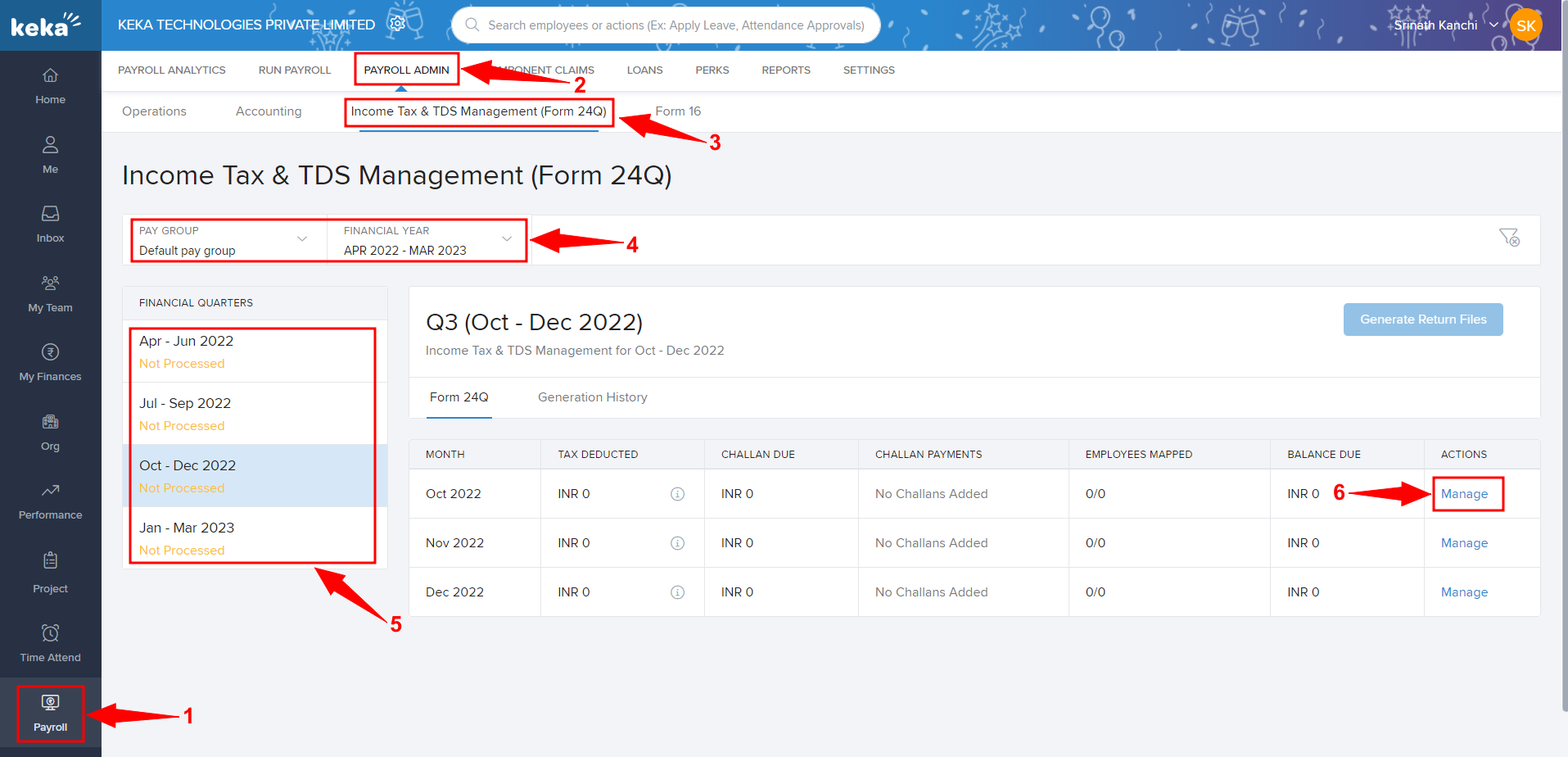

In order to generate quarterly returns (Form 24Q), log in to the Keka portal and click on Payroll (1). Go to PAYROLL ADMIN (2) and choose Income Tax & TDS Management (Form 24Q) (3).

Choose the relevant Pay Group and the Financial Year (4). Select the Financial Quarter (5) in which you can add the challans. Now, click on Manage (6).

On the window that pops up next, choose your answer to: 'How do you want to add the challan?' Now, click on 'Add Challan'. Here, you can add the challan paid to the Income Tax department.

In the window that appears, you have to update the Minor Head Code (who is paying tax), the Date it was deducted, the Bank details, and the Challan details.

Then click Next.

The system will now map the tax to employees.

Once you are satisfied with the data, click on Add Challan.

Now the Generate Return Files button will be active. Click on it to open a window.

Here, in the Return File Details section, first, you have to decide if you want to, include employees having zero (Nil) TDS returns and if you want to exclude the employee with zero gross earnings in this quarter.

Then select the Type of Deductor and the Token Number of the Previous Regular Statement.

Also, upload the CSI file here (which can be downloaded from the TRACES website)

You can refer to the Form 24Q Generation Guide and use that to proceed to the next steps.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article